136

THE COUNTY ECONOMY

PLANNING ISSUE

With a full supply or

oversupply of retail space,

older shopping centers and

highway commercial areas will

need to reinvent themselves.

Jobs of County Residents

Jobs in the County

County Businesses

Downtown and Main Street Areas

Office, Industrial, and

Brownfield Areas

Retail Commercial Areas

Tourism

Agriculture and Farm

Preservation

Employment Forecasts and

Economic Trends

What’s New

Retailing in Montgomery County has continued evolving:

•

The Plymouth Meeting Mall and King of Prussia

Malls have added restaurant clusters, while the

Montgomery Mall and Plymouth Meeting Mall have

added supermarkets. In New Jersey, the Echelon

Mall has been reinvented with the addition of a main

street, apartments, offices, and other uses.

•

Retail along the Route 422 Corridor exploded over

the past decade, when over 4,000,000 square feet of

space was added. The more notable new centers

include the Philadelphia Premium Outlets, the area’s

first suburban outlet center, the Providence Town

Center, a main-street style lifestyle center, and

Upland Square, a power center.

•

The food business has changed. Old standbys

Clemens and Genuardi’s are gone. Wegmans is new

to the local market, while Giant Food, Whole Foods,

and Trader Joe’s all grew. Discount stores, like

Target, have added food; discount wholesalers have

expanded; and drug and convenience stores

increased their food presence.

•

Many new banks, drugstores with drive-throughs,

and convenience stores with gas have been built.

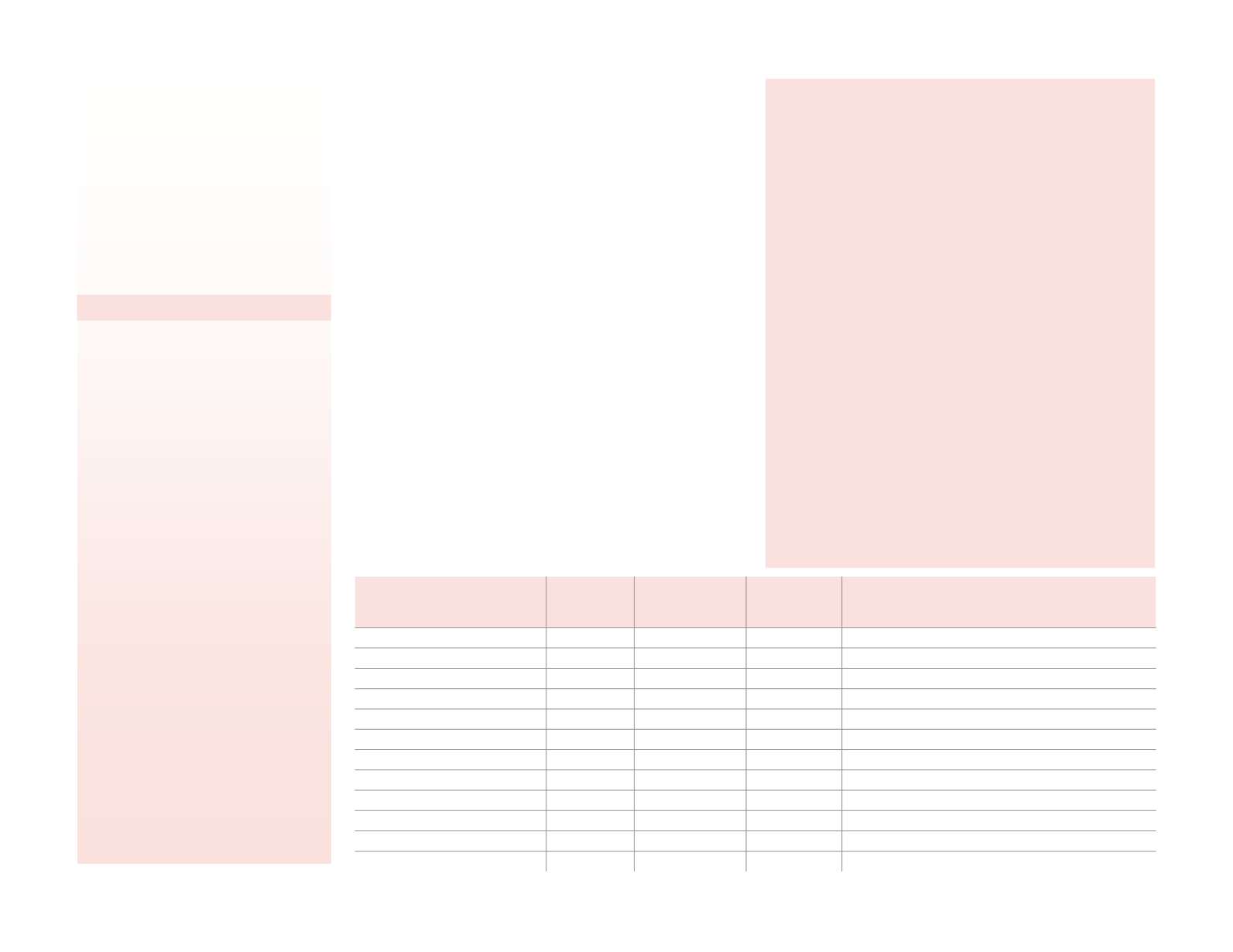

REGION

2012 RETAIL

SQUARE

FOOTAGE

ESTIMATED

2010 RETAIL

DEMAND

ESTIMATED

2040 RETAIL

DEMAND

COMMENTS

Ambler Region

1,630,000 sf

1,750,000 sf

1,940,000 sf

Go to Montgomery, Plymouth, and Abington for regional shopping

Central Perkiomen Valley

670,000 sf

910,000 sf

1,110,000 sf

Go to Route 422 Corridor for regional shopping.

Conshohocken/Plymouth Meeting

3,060,000 sf

1,100,000 sf

1,280,000 sf

Contains 1,020,000 square foot mall and large IKEA store.

Eastern Montgomery County

6,090,000 sf

2,870,000 sf

3,030,000 sf

Contains two enclosed malls with 2,530,000 square feet.

Horsham-Willow Grove

2,900,000 sf

1,680,000 sf

1,910,000 sf

Go to Abington for regional shopping.

Indian Valley

810,000 sf

1,000,000 sf

1,260,000 sf

Go to Montgomery for regional shopping.

Main Line/King of Prussia

6,820,000 sf

2,730,000 sf

2,960,000 sf

King of Prussia malls have 2,800,000 square feet.

Norristown Region

3,770,000 sf

2,170,000 sf

2,450,000 sf

Go to Plymouth and King of Prussia for regional shopping.

North Penn

6,180,000 sf

2,350,000 sf

2,670,000 sf

Contains 1,120,000 square foot mall.

Pottstown Region

2,720,000 sf

1,380,000 sf

1,700,000 sf

Go to Limerick outlets and North Coventry for regional shopping.

Spring-Ford

3,550,000 sf

1,100,000 sf

1,320,000 sf

Contains 600,000 square foot outlet center.

Upper Perkiomen Valley

590,000 sf

420,000 sf

540,000 sf

Go to Quakertown for regional shopping.

FIGURE 105:

Retail Supply and Demand by County Regions

Retail Commercial Areas

Montgomery County has much retail space and remains a

regional shopping mecca. Since 2000, the county has added

6,500,000 square feet of shopping center and big box space,

for a 2012 total of over 29,200,000 square feet. This is

about 36 square feet per person, while the national average

is 23 square feet per person for shopping centers. The

county has about 9,600,000 square feet of other retail space,

for a total of approximately 38,600,000 square feet.

The dramatic increase in retail space occurred while retail

expenditures per household declined and more shopping was

done online. Based on expenditures of approximately

$16,000 per household, the county only needs 19,600,000

square feet of retail space to meet its residents’ needs.

However, Montgomery County is a regional draw for

shoppers, which explains some of the excess supply.

Nevertheless, if all the enclosed malls and the outlet center

were subtracted from the county’s total square footage, the

county would still have over 30 million square feet of space.

With so much retail space and with new space likely to open

as retailers seek to enter the market or improve their

businesses, older commercial centers will need to change to

remain competitive.