112

THE HOMES OF MONTGOMERY COUNTY

What’s New

•

In Montgomery County, the home ownership rate

was 73.1% in 2010, well above the national rate of

65.1%. The bursting of the housing bubble at the

end of the decade sparked a surge in rental housing.

•

While lot sizes have been shrinking and living area

expanding for single family detached homes over

several decades, both measures declined further since

the Great Recession started. From 2009 through

2013, the median lot size for detached homes was

16,030 square feet, and the median living area of the

same homes was 2,918 square feet, compared to a

median lot size of 18,598 square feet and living area

of 3,094 square feet from 2000 to 2008.

Existing Housing Totals

Housing Characteristics

Housing Costs and Affordability

Senior Housing

Group Homes and Special

Needs Housing

Jobs-Housing Balance

Future Housing Demand

PLANNING ISSUE

There are a variety of housing

factors that can make

neighborhoods less desirable

or lead to decline. Some

communities may struggle

with lower than average rates

of homeownership if the

housing stock is aging, lacks

modern amenities, or is

undersized.

Housing Characteristics

Age of Housing

Montgomery County’s status as a high growth suburban

employment center with a rich heritage is reflected in its

array of housing styles and ages. Within the county, one

can find plenty of newer single-family detached

subdivisions, urban enclaves with rowhomes and twins

from over fifty years ago, recent residential conversions of

industrial land or structures, and large estate homes dating

back to the 18th century.

A little more than half of the county’s housing stock was

built in the last fifty years with the median year built being

1965. There is a greater percentage of modern housing in

the county compared to Pennsylvania where the median year

built is 1961. Compared to the nation’s median year built of

1976, the county’s housing is considerably older.

Older homes certainly add character and historical

distinction to many neighborhoods in the county. However,

they can also pose a challenge when some fall into disrepair,

or the challenges of updating and renovation create a

competitive disadvantage in the eyes of homebuyers.

Housing Tenure

Over the past decade, the rate of home ownership has

actually declined in the country, state, and every county in

the DVRPC region. This decline is fairly small and not

surprising since the banking industry and government

regulators have tightened loan standards, foreclosures have

increased, and falling housing prices have convinced some

home sellers to rent instead of sell.

One additional factor for a declining ownership rate is the

number of multifamily units that were added in the decade.

There were over 10,000 multifamily units added and many

of those units were renter-occupied apartments. Well-

maintained apartments are an important asset for the county,

providing flexibility for the workforce and attractive

housing options for those not ready to buy. The county’s

boroughs, with more apartments and higher density housing,

have the highest rates of renter-occupied housing, while the

county’s rural and more suburban townships tend to have

the highest owner-occupied housing rates.

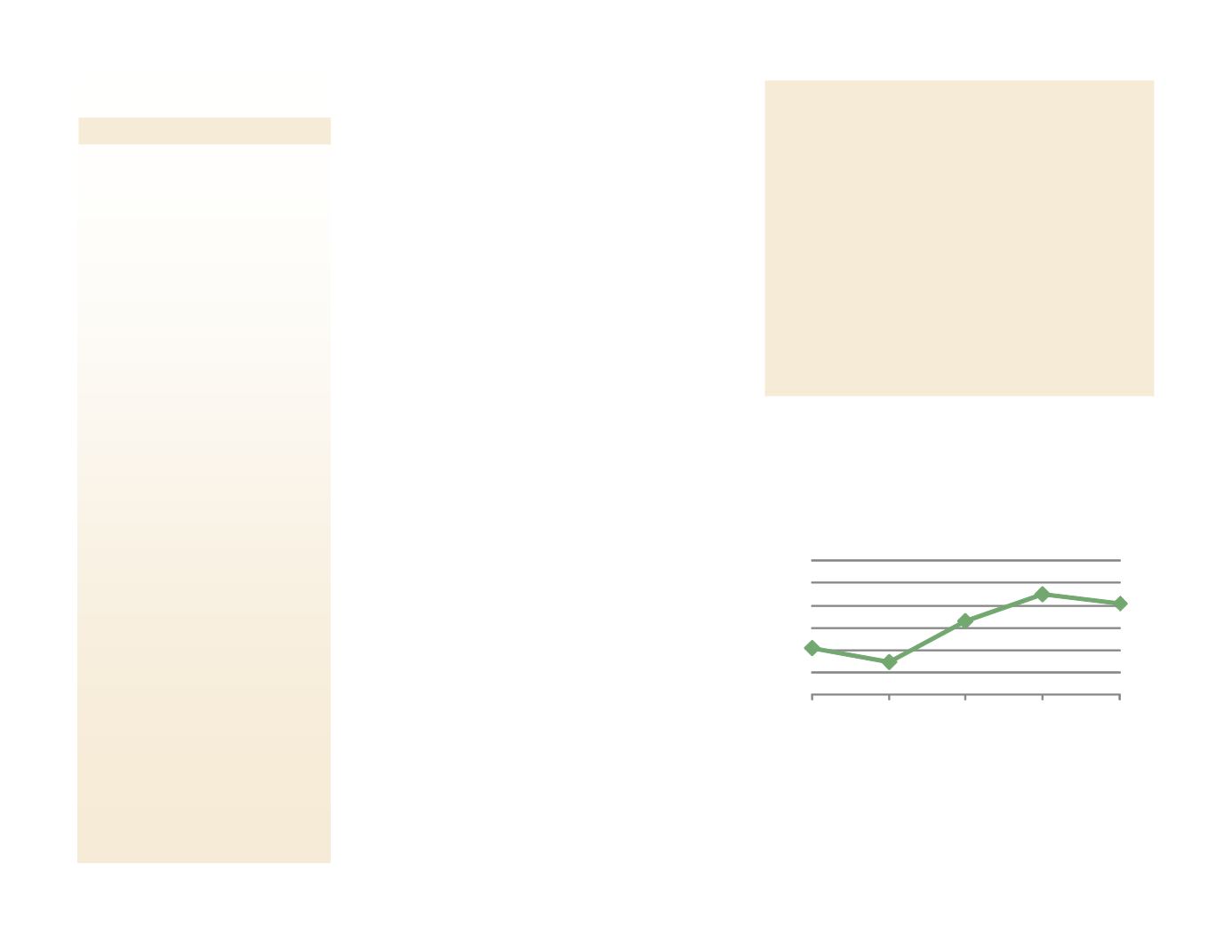

FIGURE 76:

Owner Occupied Housing Units as a Percent

of Total Occupied Units

69%

70%

71%

72%

73%

74%

75%

1970

1980

1990

2000

2010

Source: U.S. Census Bureau